Discover the Advantages of Hard Money Georgia Loans for Real Estate Investors

Discover the Advantages of Hard Money Georgia Loans for Real Estate Investors

Blog Article

Navigating the Refine: What to Anticipate When Using for a Tough Money Loan

Applying for a hard cash funding can be a nuanced process that needs a strategic strategy to ensure success. Understanding the essential steps-- from gathering essential paperwork to navigating property valuations and lending approvals-- can substantially affect your experience.

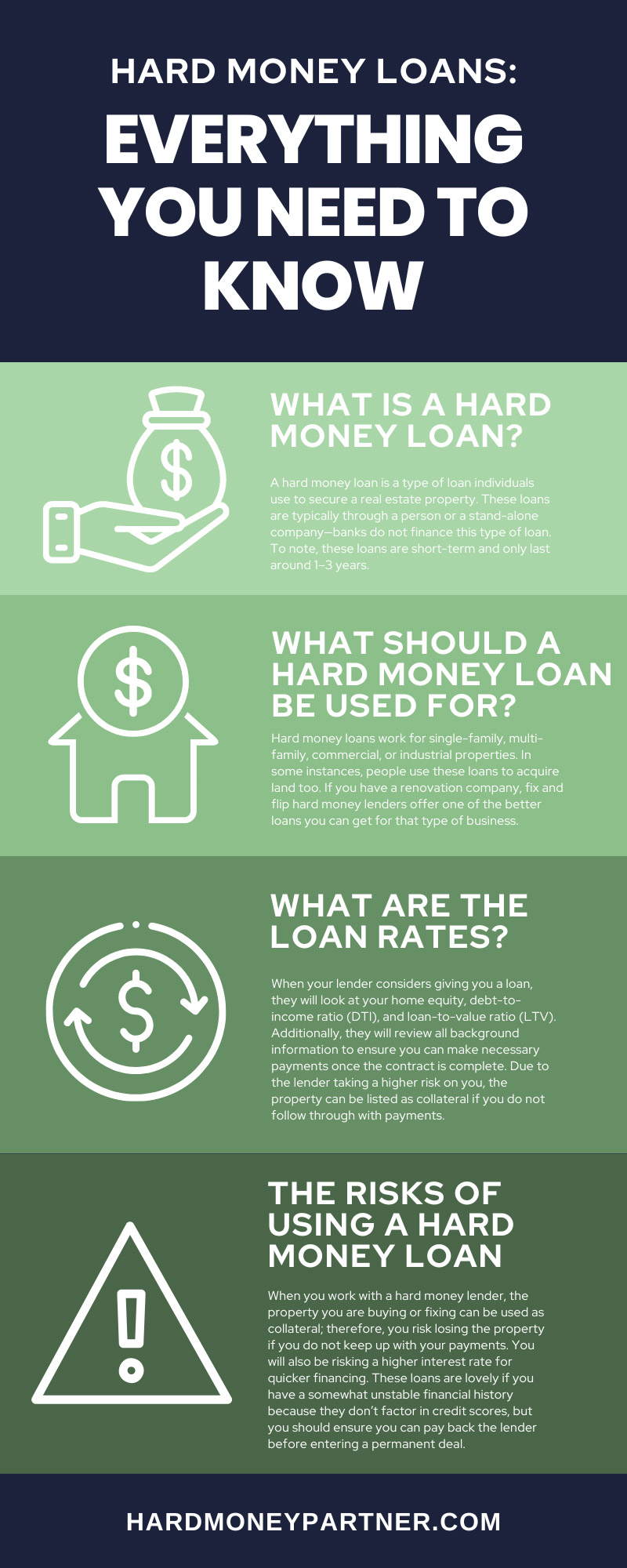

Understanding Hard Cash Lendings

Hard cash finances stand for a considerable alternative to traditional funding methods, specifically in property deals. These fundings are usually secured by the property itself as opposed to depending heavily on the consumer's credit reliability. As a result, tough money lendings are often released by personal lenders or financial investment teams, making them available to people or companies that might deal with challenges acquiring conventional funding.

One of the specifying characteristics of difficult money car loans is their expedited approval process. Unlike typical financings, which may take weeks and even months for underwriting and approval, tough money loans can typically be protected within an issue of days. This speed can be particularly helpful in competitive realty markets, where time-sensitive chances arise.

Additionally, hard money financings typically feature greater interest prices and much shorter repayment terms compared to standard loans. This shows the raised threat lenders presume when funding homes based upon security instead of borrower credit rating. Investors frequently utilize hard money fundings for fix-and-flip jobs or to swiftly get residential or commercial properties prior to safeguarding lasting funding. Understanding these essential elements is critical for anyone thinking about tough money as a financing option (hard money georgia).

Preparing Your Application

When requesting a tough cash finance, it is necessary to extensively prepare your application to improve your chances of authorization. Lenders in this area typically focus on the asset's worth over the customer's creditworthiness, but an efficient application can still make a considerable impact.

Beginning by gathering all essential paperwork, such as evidence of income, financial institution statements, and any kind of relevant economic statements. Although hard cash lending institutions are less worried concerning debt scores, offering a clear financial image can instill self-confidence in your application. Furthermore, include a detailed lending proposal outlining the purpose of the funds, the quantity requested, and your settlement plan

Consider supplying a recap of your real estate experience or past tasks, if applicable. This demonstrates your ability and raises lender count on. Make sure that your application is free from errors and simple to review, which mirrors your professionalism and trust.

Residential Property Assessment Process

Normally, the home evaluation procedure for a difficult money car loan includes a detailed analysis of the security being offered. This procedure is critical, as the loan provider mainly counts on the value of the home to safeguard the car loan. Unlike conventional fundings, where credit reliability plays a considerable function, hard money finances focus on property evaluation.

The assessment generally consists of a detailed inspection of the residential or commercial property by a qualified evaluator or real estate specialist. They analyze various variables, such as place, problem, size, and similar sales in the area, to determine the reasonable market price. In addition, the evaluator may review any type of possible problems that could impact the home's value, such as essential repair work or zoning constraints.

It is crucial for borrowers to prepare their home for this evaluation by ensuring it is totally free and well-maintained of significant flaws. Supplying any kind of pertinent documents, such as previous assessments or improvement documents, can likewise promote a smoother valuation process. Inevitably, a successful evaluation can significantly influence the regards to the lending, consisting of the quantity authorized and the rates of interest, making it an essential action in securing a hard cash car loan.

Lending Authorization Timeline

After finishing the home assessment process, customers can expect the car loan approval timeline to unfold rapidly compared to standard funding techniques. Tough money fundings are commonly characterized by their speedy authorization processes, mainly because of the asset-based nature of the lending design.

When the evaluation is complete, lenders typically call for a couple of additional records, such as proof of income and identification, to settle their analysis. This documentation process can frequently be finished within a couple of days. Following this, the lending institution will certainly review the residential or commercial property's worth and the debtor's creditworthiness, though the latter is much less emphasized than in traditional loans.

Most of the times, borrowers can anticipate preliminary approval within 24 to 72 hours after submitting the essential documents. This rapid reaction is a substantial advantage for investors looking to Check Out Your URL seize time-sensitive possibilities in realty.

Nevertheless, the final authorization timeline might vary slightly based on the loan provider's work and the complexity of the lending. Generally, borrowers can anticipate a complete approval procedure ranging from one week to 10 days, allowing them to relocate quickly in their financial investment searches. Generally, the streamlined nature of difficult cash offering deals a distinct side in the affordable realty market.

Closing the Loan

Closing the financing notes the final action in the hard cash providing procedure, where both celebrations define the agreement and transfer funds. This stage generally includes a series of vital jobs to guarantee that all economic and legal obligations are satisfied.

Prior to closing, the consumer ought to prepare for a final testimonial of the car loan terms, including rate of interest, settlement routines, and any kind of charges linked with the car loan. It is critical to attend to any kind of final inquiries or worry about the loan provider to avoid misunderstandings.

During the closing meeting, both parties will certainly authorize the needed paperwork, which may consist of the funding arrangement, cosigned promissory note, and safety and security arrangement. The lender will also need evidence of insurance policy and any type of other problems stated in the loan terms.

As soon as all files are signed, the loan provider will disburse the funds, generally via a cord transfer or check. This transfer might happen right away or within a few business days, depending on the loan provider's policies. After shutting, the consumer is officially liable for paying off the car loan according to the agreed-upon terms, noting a new phase in their economic journey.

Verdict

In summary, browsing the procedure of applying for a hard money financing calls for cautious prep work and understanding of key parts. Thorough paperwork, accurate residential or commercial property assessment, and awareness of the expedited authorization timeline are vital for a successful application. The final testimonial and closing process solidify the contract and make certain compliance with loan provider demands. An extensive understanding of these elements promotes a smoother experience and boosts the probability of safeguarding the desired car loan efficiently.

Unlike standard loans, which may take weeks or even months for underwriting and authorization, hard cash loans can typically be safeguarded within a matter of days.Moreover, tough cash financings normally come with greater passion prices and webpage much shorter payment official source terms contrasted to conventional car loans.Commonly, the residential or commercial property valuation process for a tough cash financing entails a comprehensive evaluation of the collateral being provided. Unlike standard car loans, where creditworthiness plays a significant function, tough money car loans focus on possession appraisal.

Eventually, an effective evaluation can considerably affect the terms of the financing, including the amount authorized and the rate of interest rate, making it a crucial action in securing a tough money financing.

Report this page